ACA COMPLIANCE

Paid interns can impact ACA Compliance for ALEs by adding to their full-time employee count. If hired to work at least 30 hours per week, paid interns are considered full-time employees for the ACA purposes. Misclassification of short-term employees, such […]

Read moreOn December 23, 2024, President Biden signed new legislation affecting ACA reporting, namely, the Paperwork Burden Reduction Act [PBRA]. This act eases the burden on Applicable Large Employers [ALEs] to furnish their employees with a FORM 1095-B [self-insured employers] and/or […]

Read moreIf you read only one ACA Compliance & Reporting guide this year, make sure it’s this one! There are plenty of ACA guides out there. A lot contain errors, some are plain wrong, and more and more are loosely AI-generated. […]

Read moreThe IRS ACA reporting DEADLINES for TY24 [filing in 2025] are as follows: MARCH 3, 2025: Deadline to furnish IRS FORMs 1095-B & C to individual eligible employees. MARCH 31, 2025: Deadline to e-file FORMs 1095-B & C and employer […]

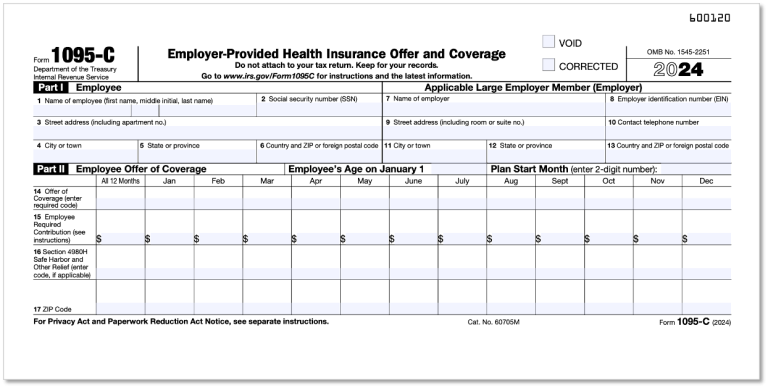

Read moreThe IRS has published the TY2024 ACA Compliance & Reporting templates for employee FORM 1095-B and FORM 1095-C. The TY24 deadlines for distributing these forms to employees and for filing to the IRS are as follows: Forms 1095 Distribution Deadline: […]

Read moreThe TY25 AFFORDABILITY THRESHOLD for calculating employer ACA compliance has been increased to 9.02% of the employee’s household income. This move by the IRS follows three years of decreases — from 9.83% in 2021 down to 8.39% for the current TY […]

Read moreAll Applicable Large Employers [ALEs] are subject to the ACA’s employer shared responsibility [ESR] provisions. They must report on ACA compliance to the IRS. Below is an explanation of how to calculate ALE status. If in any doubt, please contact BENEFITSCAPE, the leading […]

Read moreIn 2024, many smaller employers belong to Multiple Employer Welfare Arrangements [MEWAs] were caught off guard when the IRS mandated electronic filing for virtually all ACA forms, even for employers with fewer than 10 employees. The norm for these smaller […]

Read moreBy BENEFITSCAPE CHAIRMAN Ken Phillips ________________________________________________________________ The IRS has invited feedback on the ACA reporting and compliance process — more specifically, on the efficiency and utility of FORMS 1094-C and 1095-C. BENEFITSCAPE’s response is a very practical one. Our focus […]

Read moreYou met the IRS reporting deadline. But now it’s time to correct any filing errors. All Applicable Large Employers [ALEs] get one of 6 IRS responses to their Form 1094-C and Form 1095-C ACA submissions. These responses, sent via the […]

Read moreNow that the April IRS deadline for ACA reporting has come and gone, here three timely tips for employers. 1. NOW’S THE TIME TO SET UP FOR TY24. BENEFITSCAPE recommends all employers process their ACA compliance data month by month […]

Read moreWithout much fanfare, a radical data science revolution is taking place inside the Internal Revenue Service [IRS]. And all corporate employers should take note — and take steps not to get caught out by it. From 2010 to 2021, the IRS […]

Read moreThe IRS ACA reporting DEADLINES for TY23 [filing in 2024] are as follows: MARCH 1, 2024: Deadline to furnish IRS FORMs 1095-C to individual eligible employees. [This date takes in account that 2024 is a leap year.] APRIL 1, 2024: […]

Read moreThere are two series of IRS CODES for ACA reporting & compliance. These codes relate to LINES 14 & 16 of IRS FORM 1095-C, the individual employee form that as health plan sponsors APPLICABLE LARGE EMPLOYERS [ALEs] must complete and distribute to […]

Read moreWhen passed, the Affordable Care Act [ACA] required individuals to purchase & maintain qualifying health insurance coverage – or face a federal penalty. By reducing these penalties to zero in 2019, the federal Tax Cuts & Jobs Act [TCJA] effectively […]

Read moreIf you read only one online ACA guide this year, make sure it’s this one! There are lots of ‘essential’ ACA guides out there. Many are confusing. Some contain errors. As if ACA governance, risk management & compliance weren’t complicated enough. Getting […]

Read moreAs IRS filing deadlines approach in the New Year, BENEFITSCAPE takes a look at the hefty penalties for employers missing TY23 ACA deadlines. And we also issue three warnings about some misleading ACA information online. WARNING 1: Some online AI-generated guides […]

Read moreThe Patient Protection & Affordable Care Act is in robust political health in the run-up to the 2024 Presidential elections. Not one GOP candidate attacked the act during the recent TV debates [MSNBC: GOP Candidates Abandon ACA Repeal Push]; and […]

Read more