BenefitScape State Mandate eFiling Service

Effective January 1, 2019, Congress repealed the financial penalties for individuals not having health insurance, but the requirement to have health insurance is still in place.

Since then, some states have turned to state individual mandates in order to keep their healthcare marketplaces stable and generate additional revenue.

Which states have individual healthcare mandates?

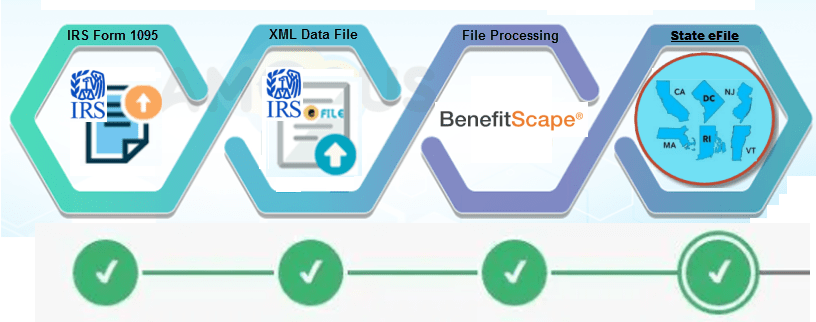

Currently, Massachusetts, California, the District of Columbia, New Jersey, Rhode Island, and Vermont have passed state individual mandates.

With each state passing its own individual mandate, it makes it difficult for companies to keep up with all the different regulations and reporting requirements. Essentially, even if you have one employee filing taxes in one of these states, your company must comply with that state’s individual mandate. This means companies will not only have to be ACA complaint at the federal level, but also at the individual state levels.

BenefitScape has obtained all of the various credentials and testing to be able to send your Federal XML file to those states currently requiring filing for Tax Year 2019. We would be pleased to work with you to accomplish the eFiling to New Jersey and the District of Columbia.