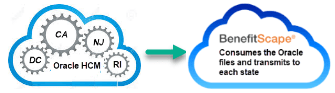

Problem Statement: In addition to IRS filing to IRSAIR, organizations also must file with CA,NJ, RI and DC, if they have employees in these states. Each state has different requirements for file processing, obtaining credentials, error correction etc. Understanding and implementing these requirements can be time consuming and error prone.

The Solution: ORACLE has a feature that creates the necessary files ready for transmission. The problem: The state filing requiirements are not easy to use. This is where BenefitScape can help. BenefitScapes takes these files the last mile and completes the requirement, filing for each state.

The Result: Complete correct compliance , saving IT and Benefit staff hours of work.

AT ASCEND 2021 Oracle outlined how to obtain the files for ACA related State mandate filing in CA, NJ, RI and DC. See Below.

- Pro Tip..If you dont want to use this process, you can simply send your Federal XML and we will take care of the restcreating and filing the state files.

1. Run the ‘Benefits ACA Transmission XML Generation Process’ and transmit files to the IRS

2. Update Transmission Status Details on the ACA Transmission Details page

3. If necessary, make corrections are transmit until status is: • “Accepted” (preferred for continuing to state reporting) or • “Partially Accepted”/ “Accepted with Error“ (allowable but will require correction filings with states)

4. Run the ‘Benefits ACA State Transmission Generation Process’ • Select appropriate jurisdiction in State parameter

5. Update Transmission Status Details on the ACA Transmission Details page • If errors are reported, run ‘Benefits ACA State process Data XML’ and make corrections • Running the ‘Benefits ACA Correction Archive Process’ will include all records identified by the IRS and states as in error.

6. If the Archive needs to be purged, State data must be removed before the IRS data can be purged.