If you read only one ACA Compliance & Reporting guide this year, make sure it’s this one! There are plenty of ACA guides out there. A lot contain errors, some are plain wrong, and more and more are loosely AI-generated.

Most are confusing, to say the least.

As if ACA governance, risk management & compliance weren’t time-consuming and complicated enough! Even the name can be confusing. Is PPACA the same as ACA? The answer, by the way, is yes; ACA is just a shorter acronym for the Patient Protection and Affordable Care Act of 2010.

Getting ACA Compliance wrong can prove not only time-consuming but costly with major fines. So as IRS deadlines accelerate toward us, we’ve done our best at BENEFITSCAPE to keep things short here: KEY TY24 CHANGES, TIPS & ERRORS.

You can download a version of this guide by clicking here.

» NOTE: if you have questions on any ACA topics not covered here — such as troubleshooting your HCM data flows, filing for an aggregated ALE, ACA challenges after a merger or acquisition — or you just prefer to talk than read, please don’t hesitate to contact BENEFITSCAPE.

We are the leading specialists in ACA Compliance & Reporting, offering a unique combination of deep benefits experience, unrivalled ACA knowledge, and a proven, practical understanding of how to deliver best-in-class ben admin on your HCM, whatever HCM you’re on.

We also boast advanced, industry-leading ACA_REGTECH, which works seamlessly with all HCM systems to run intelligent data diagnostics and other extended functionality, making ACA reporting streamlined, accurate, and hassle-free. Learn more about ACA Managed Services and ACA_REGTECH by clicking here.

BENEFITSCAPE is always happy to help.

REALLY, NO MORE PAPER FILINGS!

For TY23, the IRS had already reduced the maximum number of paper returns per Applicable Large Employers [ALE] to 10, down from 250. TY24 is no different. All ALEs need to e-file FORM 1094-C and all FORMs 1095 via the IRSAIR system [IRS ACA Information Returns]. The TY24 IRS deadline is April 1, 2025.

If you are a member of a Multiple Employer Welfare Arrangement [MEWA], it doesn’t matter that your own company is only maybe yourself or a handful of people. You will also have to file electronically as part of the MEWA.

» TIP: Transmitter Control Codes. Only IRS-certified e-filers can file via IRSAIR. If your organization does not have an IRS Transmitter Control Code [TCC], it is important to confirm your ACA vendor does. BENEFITSCAPE provides a TCC-certified filing service for employers. Securing a TCC can be a time-consuming and difficult process. So plan ahead and don’t get caught out.

» NOTE: The TY24 IRS e-filing deadline is April 1, 2025.

Batch processing means most HCMs set an earlier ACA filing ‘deadline’ than the IRS for e-filing FORMS 1094 & 1095. To avoid this constraint, BENEFITSCAPE ACA Managed Services offer all employers individual IRS submissions, regardless of which HCM is used, organizing the process around them.

COMMON ERRORS: FORM 1094-C

All ALEs must submit an employer FORM 1094-C to the IRS providing basic information about the ALE and its health coverage for employees.

FORM 1094-C, unlike FORM 1095-C, does not get distributed to employees.

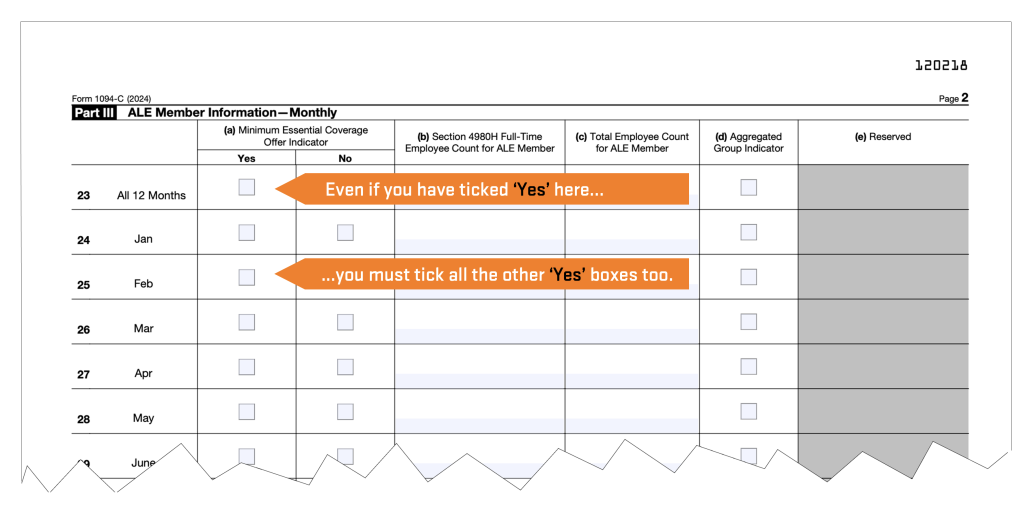

Most errors on FORM 1094-C occur in Part III, Column [a], which captures whether the ALE offered medical coverage to at least 95 percent of its full-time employees in each month of the calendar year. [See the TIP below. Also see the section on ELIGIBILITY & FULL-TIME STATUS.]

You can read more about FORM 1094-C at ACA CENTRAL on BENEFITSCAPE.com by clicking here.

» TIP: FORM 1094-C Part III, Column [a] should be carefully reviewed before submission to the IRS. Here is the most common error made by employers and reporting vendors: Despite indicating YES in the initial ‘All 12 Months’ check box, the subsequent month-by-month boxes are left blank or some ticked NO. If ‘All 12 Months’ is ticked YES, then all the month-by-month boxes need to be ticked YES too.

COMMON ERRORS: FORMs 1095-C

FORMs 1095-C are specific to each individual employee of an ALE eligible for an Offer Of Coverage under the ACA; in other words, employees with full-time status for at least one month of the reporting tax year 2024.

Part II of FORM 1095-C identifies for each month whether an Offer of Coverage was made to the employee, the employee’s own contribution amount [for self-only coverage], and an IRS Code denoting this offer and coverage status of the employee.

For an explanation of all IRS ACA Codes, go to ACA CENTRAL. 100% accurate IRS coding is just one of the end-to-end ACA services offered by BENEFITSCAPE and verified by ACA_REGTECH.

FORMs 1095-C are completed and sent to employees by the ALE, who then also submits them to the IRS along with the transmittal form. If an employee has full-time status for at least one month, all months must be coded on the form.

» NOTE: The TY24 deadline for FORM 1095-C distribution is Jan 31, 2025.

All state-mandated deadlines can be found on ACA CENTRAL at BENEFITSCAPE.com by clicking here [link: benefitscape.com/aca-central/state-aca-mandates/].

The most common FORM 1095-C errors and questions are listed below. If you have other questions, please don’t hesitate to contact BENEFITSCAPE.

LINE 16 of FORM 1095-C must never be left blank if an applicable IRS Code is available. If Offer of Coverage qualifies as affordable but is waived by the employee, the employer should still enter an Affordability Code. If Code 1A (Qualifying Offer) is entered in LINE 14, then enter Code 2G (Federal Poverty Line Safe Harbor) in LINE 16 (even if the instructions seem to indicate a Code is not necessary].

Short-term employees working 30 or more hours per week are considered full-time employees under the ACA, even if they only work 3 or 4 months and however classified (for example, short-term, temporary, interns, or co-op employees). They are NOT considered variable hour employees.

‘Variable Hour (VH) employee’ is an ACA term referring to a new hire who, at the time of hire, the employer cannot reasonably determine whether the employee will work full-time hours. The VH designation is usually used with the Look Back method [see below] for determining full-time status.

Self-employed individuals are not considered W-2 employees for ACA employer mandate purposes, and no FORM 1095-C is required. Self-employed status includes a sole proprietor, a partner in a partnership, and a 2-percent S corporation shareholder.

You can read a full account of FORM 1095-C and how it differs from FORM 1095-B on ACA CENTRAL by clicking here.

ELIGIBILITY & FULL-TIME STATUS

For TY24 ALEs are required to provide an affordable Offer of Coverage meeting both Minimum Essential Coverage [MEC] and Minimum Value [MV] to at least 95% of their Full-Time Employees. This means a value deemed comparable to insurance available on the open market and affordable [see below] based on their wages. ALEs therefore need to know which employees qualify as full-time.

» NOTE: Full-Time Equivalent [FTE] employee measures are not relevant here — only actual full-time employee status. Full-time equivalency is only used to determine an employer’s ALE status.

IRS ‘FULL-TIME’ DEFINITIONS & METHODS: A Full-Time Employee is one who works at least 30 hours of service a week or 130 hours a month.

For this purpose, ‘hours’ include each hour an employee is paid or entitled to payment for performing duties for the employer or entitled to payment even if no work is done (such as paid vacation or sick time).

The IRS approves two methods for determining an employee full-time status: the Monthly Measurement Method and the Look Back Method.

Monthly Measurement Method: This method is often recommended for employers with more structured workforces and a majority of Full-Time Employees. The advantages of Monthly Measurement are efficiency and accuracy, reducing the end-of-year resource burden as well as enabling month-by-month error diagnostics and pro-active risk management.

Look Back Method: This method can be better suited to employers with less clearly structured workforces and a shifting mix of part-time, full-time, and even seasonal employees. The Look Back Method is required to process eligibility for Variable Hour Employees [see above].

For a full explanation of both these methods, go to ACA CENTRAL on BENEFITSCAPE.com by clicking here. BENEFITSCAPE ACA Managed Services include both methods depending on which fits the employer’s needs best. ACA_REGTECH runs diagnostics & data visualization to support accurate and efficient eligibility management for variable workforces and complex hours tracking.

IRS AFFORDABILITY THRESHOLD FOR TY24

As stated above, the employer’s Offer of Coverage to eligible employees must be affordable. The offer is deemed affordable if the employee’s required contribution for self-only coverage in the employer’s lowest cost plan does not exceed a specified percentage of the employee’s household income (even if the employee is enrolled in family coverage).

This affordability percentage was set at 8.39% for TY24.

Because employers do not know their employees’ household incomes, the ACA permits employers to determine affordability using certain Safe Harbor Methods as a proxy for household income.

CHOOSING AN AFFORDABILITY SAFE HARBOR: ALEs are not required to use the same Safe Harbor method for all Full-Time Employees. Different methods may be used for different business classifications as specified in the ACA regulations. But within each classification these Safe Harbor methods must be applied consistently; ALEs can’t apply different methods on an employee-by-employee basis.

Here is a quick guide to those different Safe Harbor Methods:

» W-2: This Safe Harbor method generally maximizes the employee’s contribution. It works well: for a workforce whose earnings can be predicted with some certainty, and contributions can be structured as a percentage of weekly earnings. On the down side: this method can only be calculated after the close of the calendar year and is based on the employee’s income reported in W-2 BOX 1.

» RATE OF PAY: This method calculates affordability on a monthly basis, using the employee’s hourly rate of pay on the first day of the plan year. This method works well: for employer with significant number of hourly employees. On the down side: this method can’t be used for tipped and commission employees; and the Rate of Pay calculation is limited to 130 hours of service/month.

» FEDERAL POVERTY LEVEL (FPL): This is the simplest method but requires the highest employer contribution of the three Safe Harbors.

For more information about AFFORDABILITY, including Safe Harbors and up-to-date FPL data, go to ACA CENTRAL on BENEFITSCAPE.com by clicking here.

» TIP: Medical opt-out and wellness program incentives may impact affordability calculations and need to be properly structured to manage this impact.

» NOTE: Affordable Coverage & IRS Penalties. The potential penalty ALEs face for offering eligible employees only unaffordable coverage is the penalty for non-compliance of IR CODE 4980H[b], also known as ‘PENALTY B’. Learn more on ACA CENTRAL by clicking here. All PENALTY B risk exposure lies with eligible employees who have waived coverage, since this penalty is not automatic and triggered only when an employee who has waived [unaffordable] coverage on offer then enrolls in a Health Insurance Marketplace [also called Exchanges] to purchase coverage and benefit from a federal premium tax credit lowering monthly payments.

Any employees enrolled in unaffordable coverage [FORM 1095-C Line 16,Code 2C] do not automatically trigger PENALTY B, since they are not enrolled in a Health Insurance Marketplace with federal premium tax credit assistance.

TECH + EXPERTISE – RISK = ACA COMPLIANCE

No HCM, even with an advanced ACA module, does all the ACA work for you. Of course not. Tech is a tool, even in the age of AI. In fact, even the magic worked on your HCM data by BENEFITSCAPE ACA_REGTECH is not a blind plug and play. Nothing totally replaces human expertise. Specially for matters of compliance. Well, not yet at least!

You must be confident your ACA vendor has the proven experience of ACA governance, risk management, and compliance to take on board the latest IRS regs & requirements as well as your company’s unique business rules, health plan provisions, and employee population.

ACA compliance has a lot of rigid rules but is not an exact science, because no two employers have exactly the same needs or circumstances, and ACA reporting is the most granular employee data your HCM will ever have to process. All ACA filings need expert compliance oversight however intelligent the technology.

» TIP: Do not green light IRS filing unless you are 100% confident any gaps, anomalies, or other data processing issues have been addressed. It is much more time-consuming and costly to put things right later. That’s why BENEFITSCAPE ACA_REGTECH runs Flag & Fix diagnostics throughout the ACA process and a full IRS filing simulation prior to all final submission.

CONCLUSION

So there you have it. Everything we hope you ever wanted to know about ACA Reporting & Compliance. Maybe more!

That said, you can find further detailed information about all aspects of ACA Compliance and Reporting by going to ACA CENTRAL on the BENEFITSCAPE website by clicking here. ACA CENTRAL is constantly updated with the latest ACA insight and intelligence from our leading specialists.

Whatever your ACA needs, from urgent data or HCM troubleshooting to final IRS filings via the IRSAIR system, or everything in-between, please do not hesitate to contact BENEFITSCAPE. We have you covered, thanks to a unique combination of benefits experience, compliance expertise & advanced data science, including a deep understanding of all major HCMs and advanced ACA_REGTECH and diagnostics that work friction-free with all systems and native data sources.

Even the IRS hires BENEFITSCAPE for our advanced regtech capabilities.

Call +1-508-655-3307, email info@benefitscape.com or visit BENEFITSCAPE.com.