There are two series of IRS CODES for ACA reporting & compliance.

These codes relate to LINES 14 & 16 of IRS FORM 1095-C, the individual employee form that as health plan sponsors APPLICABLE LARGE EMPLOYERS [ALEs] must complete and distribute to all eligible employees.

See here for the difference between FORMS 1095-B & 1095-C.

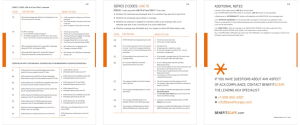

Series 1 Codes: Line 14

SERIES 1 CODES are used to populate LINE 14 of FORM 1095-C. They code the employer’s Offer of Coverage to the individual employee.

» Was an individual offered coverage?

» What type of coverage were they offered?

» Plus what months was the coverage offered or not offered?

FORM 1095-C requires a value for each month, which can be represented by checking either the ‘ALL 12 MONTHS’ box or by entering a value for each individual month.

Series 2 Codes: Line 16

SERIES 2 CODES are used to populate LINE 16 of FORM 1095-C. They code:

» Whether the individual was EMPLOYED and FULL OR PART-TIME.

» Whether the employee was ENROLLED in coverage.

» Whether the employer is eligible for TRANSITION RELIEF [as an employer with a non-calendar year plan or as a contributor to a union health plan].

» Whether coverage was AFFORDABLE and based on which SAFE HARBOR.

To find out more about AFFORDABILITY SAFE HARBORS click here.

Download here a REFERENCE SHEET of all IRS SERIES 1 & 2 CODES for TY23.

» NOTE: LINE 15 of FORM 1095-C relates to offer AFFORDABILITY, recording where required the lowest-cost, self-only coverage offered the employee each month. Certain OFFER CODES require LINE 15 to remain blank.

E.g. for OFFER CODE 1A or 1G, LINE 15 should NOT be populated.

» NOTE: REFERENCES TO AFFORDABILITY relate to employee-only coverage level.

» NOTE: AN OFFER OF COVERAGE is one that provides coverage for every day of a calendar month. There is an exception for terminated employees who would have been covered for the entire month, if not for the termination.

» NOTE: A CONDITIONAL OFFER OF COVERAGE to an employee’s spouse is an offer under which the employee and/or spouse must meet or not meet one or more criteria.

E.g. the employee’s spouse may enroll only if the spouse is not eligible for coverage in his/her own employer-sponsored plan.

________________________________

If you have questions regarding IRS CODING or any other aspect of ACA reporting & compliance, please contact BENEFITSCAPE, the leading ACA specialist.

BENEFITSCAPE provides best-in-class ACA services & intelligent FLAG & FIX REGTECH DIAGNOSTICS to 1000s of employers of all sizes, in all sectors, and on all major HCMs.