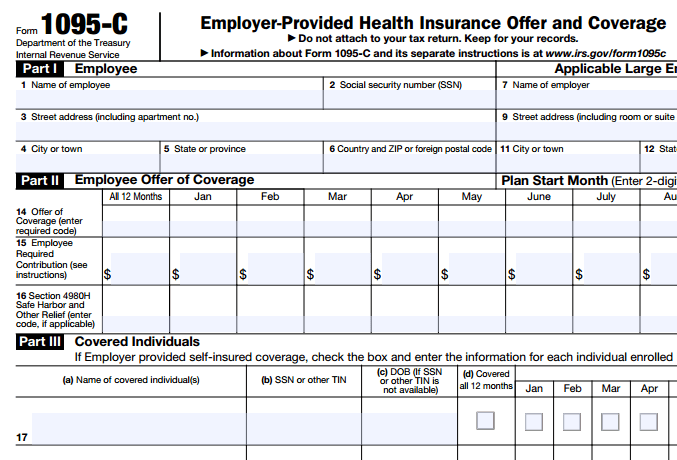

Important news! On July 13, 2020, the IRS released its draft TY2020 Forms 1095-C and 1094-C with some significant changes.

The Form 1095-C has been updated to include the addition of new codes (IS through IZ) on Page 2 of the instructions section of the Form 1095-C. These new codes relate to individual coverage health reimbursement arrangements (HRAs) and addresses Executive Order No. 13813, effective January 2020, allowing employers to use individual coverage HRAs to reimburse employees for the cost of health insurance coverage purchased in the individual health insurance marketplace.

Another significant update relates to Line 17 on Form 1095-C which asks for monthly zip code information for those employees who were offered coverage through an individual coverage HRA. The monthly zip code corresponds to the employee’s work location or primary residence depending on whether affordability of that coverage was determined based on location.

There are no changes to the Form 1094-C from the prior year, but it’s important to keep in mind that depending on how these changes impact your reporting on Form 1095-C, your Form 1094-C data may also change.

BenefitScape is here to provide your organization with complete ACA Compliance and Reporting solutions. Call us at (508) 655-3307 or email info@benefitscape.com to learn more.

Attachment(s):

Draft TY2020 1095-C.pdf

Draft TY2020 1094-C.pdf